Peer to Peer Lending Platform Development

The practice of lending and borrowing is as old as the invention of money. It still exists and will continue to do so in the future. The concept of funding has evolved significantly over the years, and now, with the help of technology, one can get funds within a few clicks. Blockchain is one such technology powerhouse that is transforming finance infrastructure across the globe.

In a recent addition to the system, blockchain-based Peer-to-Peer (P2P) lending software allows two parties to satisfy their particular financial needs without any third-party at a reduced cost. It will grow up to be a highly-secured and hassle-free lending system of the future. Take advantage of blockchain technology and launch your P2P lending software with the help of our experts.

Blockchain-Based P2P Crypto Lending

As a premier lending platform development company, we provide our consumers with the tools they need to get their peer-to-peer crypto lending platform off the ground to roaring success.

Blockchain-Based P2P Fiat Lending

If you’re looking for a more traditional approach to build your trading platform on, we provide cutting edge P2P fiat lending platform development services that are cost-effective and proven to be successful.

Blockchain-based P2P cross lending platform

Our P2P cross lending platform development services are the perfect mix between traditional fiat currencies and the innovative nature of cryptocurrencies. In the absence of industry-wide penetration of cryptocurrencies, a cross lending platform is just what you need.

What Is Peer-to-Peer Lending?

Peer-to-peer lending is a popular alternative to availing loans other than traditional banking systems. Individuals can get the loan amount from other individuals after fulfilling the conditions. Unlike conventional lending processes, where intermediaries like loan officers, banks, underwriters, and loan processors are involved, P2P lending eliminates all the intermediaries from the current system. In return, borrowers and lenders can connect quickly at a much-reduced cost. The borrowers can also get the required finance faster, and lenders can also have the whole procedure in place with smart contracts.

One of the main advantages of P2P lending, lenders can get better returns than the savings account. For borrowers, those who don't have enough credit score to be qualified for traditional bank loans can make use of this process.

Top Reasons To Implement Blockchain In P2P Lending

- No-third party or intermediary involved

- Reduced processing fees

- Quick access to loan than the traditional method

- Standardized rate of interest

- High-transparency

- No hidden cost involved

- Smart contract-enabled loan process

- Interest can be paid out with cryptocurrencies

- Better return on investment.

- Easy to connect the matching lenders and borrowers.

- Some P2P lending platform allows lenders and borrowers to negotiate the interest rate and repayment timeline

Unique Features of Our P2P Crypto lending Platforms

No Third-Party Beneficiaries

Blockchain-based P2P crypto lending platforms use smart contracts to execute the deal between the borrower and lender without the need of any third-party. They easily interact with a blockchain network securely.

Trusted and Secured

The whole process of lending is taken care of based on the predefined guidelines with the help of smart contracts without any human intervention. This guarantees that the process runs smoothly and eliminates possible errors. So, the P2P platform provides high security and trust to its users.

Decentralization

Blockchain enables the lender to remain anonymous without revealing one's identity other than the initial platform registration. A lender can select the loan type from the marketplace that he/she prefers to offer and conduct the process from the wallet.

Loan Origination Process

The loan origination is the complete process from applying for the loan by the borrower to the lender's disbursal of funds. Our lending platform development will let the platform assist in the origination process via the Peer-to-Peer lending system.

Loan Calculator

The loan calculator will help to determine the Equated Monthly Installment (EMI) repayment amount, the interest cost, deferred payment loans, etc. This helps the borrower and lender be clear with what they have agreed to payback and receive, respectively.

Credit Score

In the current system, the credit score of an individual defines the trustworthiness of a person's financial commitment and repayable capacity. This will help the investor or lender to decide on the borrower.

Multi-layer Security

We enabled the P2P cryptocurrency lending platform with an updated security system with SSL certification and two-factor authentication to provide safe and secure login with encryption.

Refinance Management

Refinancing is one of the good features for a borrower who has already paid half of the repayment amount within the said period. This feature allows a borrower to get access to a new loan from another lender to refinance himself.

KYC and AML

Location-based Know Your Customer (KYC), and Anti-Money Laundering (AML) verification processes confirm users' identities and are used when the withdrawal of cryptocurrencies is equivalent to a specific amount and above.

Escrow System

A secured and smart-contract driven contractual escrow system automates the locking and releasing of users crypto assets for instant and third-party transactions.

Hot Wallet

The hot wallet enabled P2P lending blockchain will allow both the buyer and seller to hold, send, receive a spectrum of cryptocurrency as per your transaction in a secure manner.

LVR Calculation

Loan Valuation Ratio is the percentage of collateral value that you're borrowing. LVR calculator will help the lender to access the loan application. This benefits both the borrower and the lender to make an informed decision before applying for it.

Auto-Renewal of Loans

This auto-renewal feature will reduce the manual process of putting lending orders in the order book; instead, a user can toggle between ON & OFF as per the need.

Terms & Conditions of the platform

Considering transparency between the borrower, lender, and the platform has the priority of the Peer-to-Peer lending application, you can establish terms and conditions of the stage and the lending service you offer within the platform before they can proceed further.

Loan Feedback

User feedback always plays a crucial role in the growth and development of the platform and its features. Users can give input from his/her about the loan performance, repayment of the loan, etc. This will help the lenders to participate in a funding process that has easy returns with less risk.

Auto-Investment

This is one of the must-have features in your P2P lending platform, allowing the lender to invest in high-yield areas and low risk. It helps the users to diversify their portfolio securely.

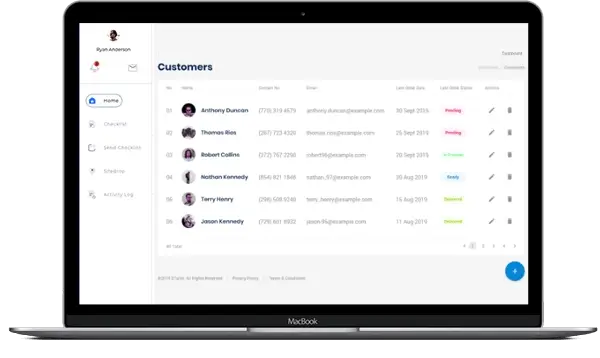

Lender Management

The lender management system helps in sourcing the potential borrower with the person's detailed application like amount required, loan tenure, KYC, CIBIL score, etc. Lenders will get the borrower profiles as recommendations based on one's capacity of lending.

Document Management

A Document Management system helps both the borrower and lender to access the documents easily, as and when required. Most importantly, the borrower can submit the profile and documents to the lender, and the lender can access the potential leads document before entering into a financial commitment.

Know Your Limits

The feature will help the lender to limit lending based on their documents uploaded like income sources and tax paid. For the borrowers, they can check the eligibility of the total loan amount. It is based on the pre-set criteria of the loan distribution application.

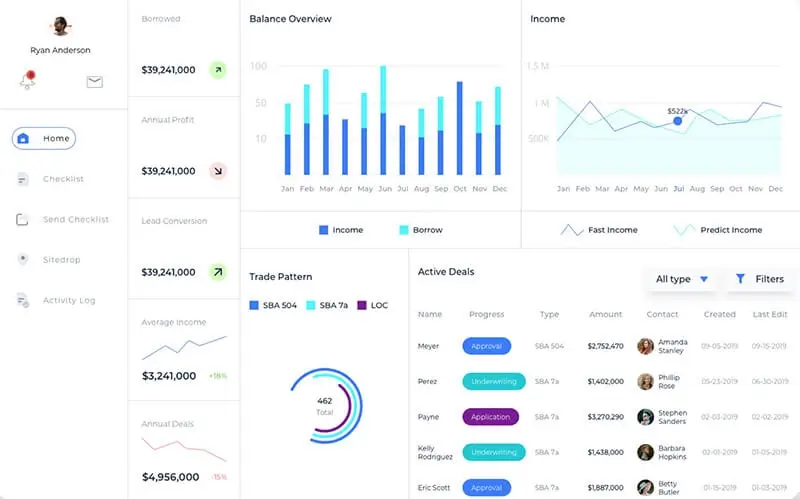

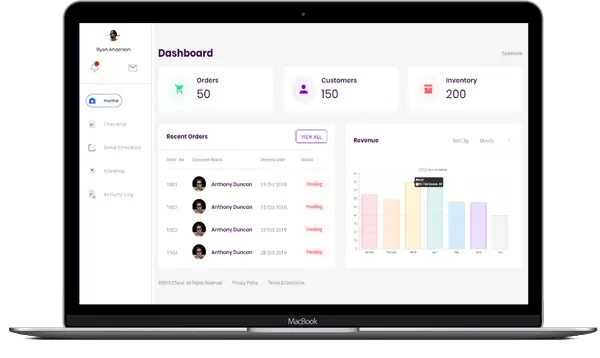

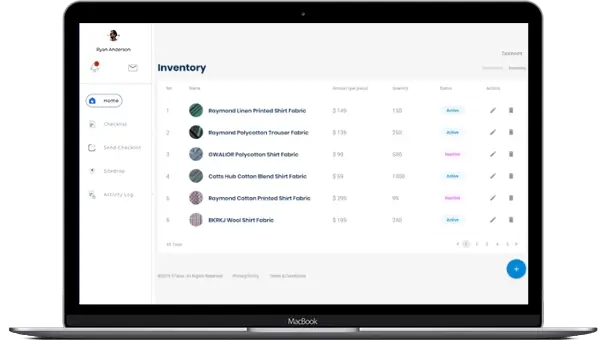

DashBoard

All the registered borrowers and lenders can have a dashboard in the P2P lending platform, but both lenders and borrowers dashboard differs in the data they carry. For example, the lender's dashboard will have information about the total amount transferred to the borrowers as a whole. For any particular person, balance in the wallet, complete repayment stats of the specific person, and the overall payment received.

Lead Management

Lenders can manage leads, create leads, track the repayment status, summarize the amount disbursed, repayment tenure of the borrower, balance, KYC documents, E-signature, etc. After every successful commitment and closure of the deal, the lender can add comments and notes to the lead. The system is created to help the lender to plan for further investment properly.

Borrower Management

Borrower Management enables him/her to submit a detailed application with all the required documents, information to be eligible for availing loans. In this way, the borrower can get notified by the lender who is ready to provide funds without any procedural hiccups.

Key Security Features Of Our Peer-to-peer Lending Software

Data Encryption

Our data encryption policy protects users' credentials and safeguards all the sensitive information stored in the database.

JWT Encryption

JSON Web token with RSA encryption to protect the data against the platform manipulation.

Anti-Distributed Denial Of Service

Anti-distributed denial of service protection from attacks in an attempt to make a machine or network unavailable for potential users.

SQL Injection Protected

Safeguard the platform from malicious inputs submitted by the attackers.

Prevent Self-XSS

This protects from illegal access to users' accounts without proper authorization.

SSRF Prevention

Server-Side Request Forgery (SSRF) attack wherein the users create or control requests from vulnerable servers.

HTTP Parameter Protection

Prevents the HTTP request of retrieving and accessing hidden information in the network

Login Forgery

A registered user can have access to a single login to the platform to ensure the user accesses this account with security and also keep a check on multiple user logins the same story.

Anti-denial Of Service (Dos)

Attack Protection

Anti-denial service protects the platform from a large number of requests to the server from the attackers and makes sure the platform is available for intended users.

How does P2P Lending Work?

1 Lender - Sign Up and Profile Creation

Every lender who is willing to lend funds to the potential borrower must create a lender's profile with the following information to proceed further:

- Personal Information (Full Name, Resident Address, ID Proof, Contact Details)

- Complete Bank Account Details

- Interested Investment Type & Lending Criteria

2 Borrower - Sign Up and Profile Creation

Like a lender, a borrower has to create a profile in the Peer-to-Peer lending platform with the following details:

- Personal Details

- Credit Score

- Legal Documents

- Collateral Details

- Third-party Guarantor

3 Borrower initiates loan request

The borrower can send loan requests to all the lenders in the network and let them know about it along with your profile information. The smart contract will enable this process.

4 The lender gets for loan requests.

After the successful creation of the lender's profile, the lender will start to get feed about potential borrowers. The lender can go through their profile and schedule a call with the borrower.

5 Matching the lender and borrower

The matching engine in the platform will set to find the relevant profile and helps to choose the potential borrower and lenders to close the deal. This ensures a secured P2P lending experience that is beneficial to both parties.

6 Lender interacts with the borrower

Once the lender selects the profile, he can schedule a call or meeting with the borrower to understand the borrower and his/her purpose of borrowing the amount.

- Why do you want to take a loan?

- Monthly income of the borrower

- Credit History

- Rate of repayment

7 Smart Contract Fixes the Loan Interest

Based on the creditworthiness of the borrower and lending interest of the investor, a smart contract fixes the loan interest rate. The smart contract also helps categorize the borrower as high-risk, medium-risk, and low-risk borrowers based on their repayment rates.

8 The lender sends loan amount to the borrower

After the successful completion of the process, as mentioned above, the lender can send the loan directly from his wallet. Now, the borrower is liable to pay back the loan amount with the interest rate.

9 Smart Contract-enabled Auto Repayment

Based on the agreed terms, the borrower can repay the loan amount as a monthly or quarterly installment using a smart contract embedded in the wallet. If the borrower doesn't pay the loan amount, the smart contract deducts the penalty amount. Failure to repay the loan will lead to selling the collaterals in the market.

Features of our All-in-one Admin Panel

Summarized Data Dashboard

- User registration data

- Total active users

- Total transactions

- Escrow account

- Balance of all cryptocurrencies

- Total loans and interest

Funding Order Management

- Trade summary

- Deposit summary

- Borrower's withdrawal summary

- Lending and Borrowing Orders

Lending Management

- Finance KPI

- Lending KPI

- Fees System

- Bids history

Real-time Reporting

- Lending report

- Borrowers credit rating report

- Pending transactions

- Non-performing assets report

- Profit report

Why Blockchain App Factory To Develop P2P Lending Platform?

Developing a Peer-to-Peer lending platform is not as easy as it looks; it involves a series of work from planning to launching an application in the market. Most importantly, understanding the client requirement and giving them the much-required software solution defines the growth of the platform in the market.

At Blockchain App Factory, we ensure blockchain experts with proven experience work on developing your platform. Our team will conduct thorough research and evaluate all the factors and interact with you regularly to understand your requirements. We make sure our final product satisfies all your business requirements and keep you at ease during the entire development process so that you can stay focused on building your brand and other business activities.

- Timely Project Delivery

- Through Research & Development

- Experienced Blockchain and smart contract developers

- Customization as per the requirement

- Cost-effective development solution

FAQ

We Spotlighted In

We are Partnering With