The 21st century has been counted by many as the time when digital technology takes over the world in all possible ways. Asset tokenization is an element that has broken a lot of barriers in today’s world. Blockchains have been instrumental in bringing together physical and digital entities while ensuring top-level security and performance. Especially asset tokenization on Polygon has become a trend adopted by many businesses and high-net-worth individuals for many reasons. We will see about this in this blog in more detail with added insights from our experts. This quote from Gun Gun Febrianza, a popular figure in the Indonesian Web3 space, decodes the role of blockchain in exchanging value.

“Everything will be tokenized, blockchain will become fundamental building blocks of value exchange.”

Table of Contents

- What is Asset Tokenization?

- Polygon: A Refresher

- Why Conduct Asset Tokenization on Polygon?

- Benefits of Asset Tokenization on Polygon

- The Process Behind Asset Tokenization on Polygon

- Vital Elements of Asset Tokenization on Polygon

- Conclusion

What is Asset Tokenization?

Asset tokenization is the process of creating blockchain-backed entries for digital and physical items. It is incredibly popular with assets like real estate properties, artworks, digital collectibles, and antique items. The process has been behind the famous crypto fundraising mechanism Security Token Offering which revolves around distributing crypto tokens backed by shares in real-world assets.

Tokenizing assets had become popular mainly because of the initial crypto fundraising mayhem when several malicious actors executed scams through ultra-decentralized initial coin offerings (ICO) when the system was still nascent. Offering tokens supported by tangible assets became the solution for projects to preserve their credibility.

Crowdfunding through the process works both for digital-native and physical-native businesses, as demonstrated by crypto applications and construction projects. The process also utilizes tokens of different types – those based on nature and speculation. Tangible assets, fungible assets, and non-fungible assets comprise tokens based on nature. Currency tokens, utility tokens, and security tokens include tokens based on speculation.

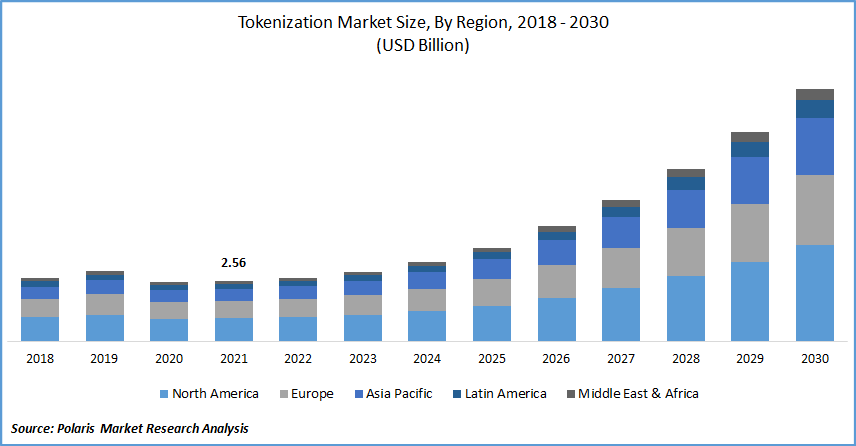

Ethereum, Polygon, BNB Chain, Solana, and Avalanche are some widely used blockchain networks for tokenizing assets. A report from Polaris Market Research indicates that the asset tokenization market has a size of nearly US$3 billion in 2023 and is expected to exceed US$10.75 billion in 2030 at an annual compound annual growth rate (CAGR) of 18.9%. This shows the value tokenization has in the current market.

Polygon: A Refresher

Polygon (Previously Matic Network) is a layer-2 blockchain built on the Ethereum network that was initially released in 2017. Since then, the network has been the subject of many advancements, especially after rebranding itself to its current name. The solution offers faster and cheaper transactions using a scalable provision while tapping into the unbreakable security of Ethereum.

The Polygon network has become the technological partner for several globally renowned brands’ Web3 forays, including Starbucks, Meta, Stripe, The Walt Disney Company, Adidas, and Prada. Such collaborations, alongside numerous innovative projects, make Polygon the perfect ecosystem for businesses and users looking for Ethereum alternatives.

Polygon PoS works as an Ethereum scaling system compatible with the Ethereum Virtual Machine (EVM). Its zkEVM offers security using zero-knowledge rollups competent to work with the EVM. The network now lets users build exclusive blockchains through its Supernets that enable businesses to operate using the Polygon’s ecosystem.

The network has a native token, $MATIC, that currently occupies the 13th spot among the top cryptocurrencies in terms of market capitalization with a value exceeding US$5 billion, according to CoinMarketCap. Such adoption levels are partly due to the network’s prominence in the current crypto market.

Why Conduct Asset Tokenization on Polygon?

Asset tokenization on Polygon has become a sensation in recent years owing to the sheer number of businesses entering the blockchain space. With Polygon’s longevity, proposition, and brand value, most utilized the network to tokenize and distribute assets, hence paving the way for their businesses in Web3.

Since the blockchain has access to Ethereum’s community within reach, businesses wishing to tokenize and sell their assets can do so easily. This lets them save significant resources without having to burden themselves with the excessive congestion and gas fees associated with Ethereum. Its compatibility with the EVM also allows ventures to access other blockchain networks very easily.

For businesses planning on a bigger scale, Polygon’s Supernets can come in handy, and the reputation this network has outplays other providers of such sub-blockchains, such as Avalanche and Polkadot. Also, platforms like PolygonX, Polymath, and Synthetix have revolutionized the prospects for tokenization on the Polygon network.

The Polygon blockchain also provides extensive support for developers to create decentralized applications (dApps) that can be used for tokenization purposes. There is an active market focusing on the tokenization of assets on Polygon, which is an essential factor behind why the network is a feasible option for aspiring crypto businesses.

“Tokenize Your Assets on Polygon to Gain Loads Out of Their New Value!!”

Benefits of Asset Tokenization on Polygon

- Cost Efficiency: Tokenizing assets on Polygon comes at much lesser costs compared to the Ethereum main network due to the latter’s scalability concerns and easily-congestible nature.

- Liquidity: Creating tokens backing assets on the Polygon network enhances liquidity for these assets as investors can now purchase and sell fractions of assets for smaller costs, slashing entry barriers.

- Global Accessibility: Utilizing a globally-renowned L2 network like Polygon for asset tokenization can open up chances for people worldwide to participate in investments in asset-backed tokens.

- Anytime Market Access: Since assets exist on the blockchain, people can conduct trading activities at all times, unlike traditional asset markets that are bound to various restrictions.

- Intermediary-Less Process: Trading tokenized assets through a platform on Polygon facilitates direct transactions between buyers and sellers without any involvement of intermediaries and associated costs.

- Automated Compliance: Using smart contracts, asset tokenization apps on Polygon can ensure user compliance through automated mechanisms that mandate Know-Your-Customer (KYC) and Anti-Money Laundering (AML) requirements.

- Reduced Counterparty Risk: Efficient smart contracts on Polygon also get rid of counterparty risk by processing transactions only if pre-agreed conditions are reached.

Interoperable Provisions: Since Polygon is EVM-compatible, tokenization of assets on the network allows businesses to tap into more markets with less work.

The Process Behind Asset Tokenization on Polygon

- Assessing the Asset: The process of tokenizing an asset on Polygon begins with evaluating the entity involved. Doing so includes its value, legalities, and market demand (both current and projected). Based on the insights earned, the tokenization process for this asset can be structured to define how tokens will be distributed and utilized.

- Coding Smart Contracts: Creating smart contracts for the tokenization process is important as they facilitate the creation and distribution of asset tokens. Stages such as token issuance, ownership verification, dividend distribution, and other specific terms are orchestrated through these programs. We use programming languages like Solidity to develop smart contracts on Polygon.

- Token Development and Distribution: As we code the relevant smart contracts, tokens representing the ownership of the asset in question are minted on the Polygon network. The token volume depends on the market size you wish to target and the asset’s intrinsic value and significance. We then distribute these tokens to the business owner.

- Regulatory Compliance Fulfillment: Complying with regulatory requirements is mandatory when it comes to tokenizing assets on Polygon, as the current real estate industry is bound by numerous legalities. We ensure to fulfill necessary legal regulations for the jurisdictions involved to offer ideal experiences for investors and businesses in the long run.

- Listing Tokens on Supported Platforms: Now, we integrate these tokens into a platform compatible with the Polygon network, such as a CEX or a DEX. Listing on such crypto exchanges can enable asset owners to expose their tokens to a wider market, added with the benefits of increased liquidity and an active economy.

- Investor Onboarding and Verification: The tokenization campaign now proceeds to onboarding investors. Many marketing strategies are employed to attract people and build a trusted community. Customer verification is carried out to comply with KYC and AML requirements that keep illicit players in check.

- Post-Launch Activities: After listing tokens for sale, people can trade their tokens secondarily. As a business, you can implement governance mechanisms, manage the asset, maintain its value, and ensure necessary compliance. Periodic maintenance of the smart contracts should be conducted to ensure optimal operations at all times.

“Become Part of the Exciting Polygon Ecosystem by Tokenizing Your Assets!”

Vital Elements of Asset Tokenization on Polygon

When you consider tokenizing your assets on Polygon, multiple elements need to be considered to obtain desired results. Since the process involves numerous real and virtual world entities, working with a reputed team like ours is suggested. Here are the key elements to be considered during asset tokenization on Polygon to ensure the campaign’s success:

- Smart Contracts

- Token Standards

- Identity and Verification

- Custodianship and Security

- Decentralized Oracles

- Legal Framework and Compliance

- Marketplaces and Exchanges

- User Interfaces and Experiences

- Scalability and Performance

- Interoperability

- Auditability and Transparency

- Legal Documentation

- Token Management

Henceforth, we have seen everything about asset tokenization on Polygon. With this Ethereum Layer-2 network evolving to outplay other leading blockchains, tokenizing assets on it could prove perfect for aspiring enterprises. If you are an entrepreneur looking to tap into physical assets for fundraising or a realtor looking to ramp up sales of expensive real estate, tokenization on Polygon could be worth the effort. With Blockchain App Factory’s experts, you can mint tokens on-chain effortlessly and strive toward your missions seamlessly. Fill out the form below now to initiate a business meeting with our professionals!