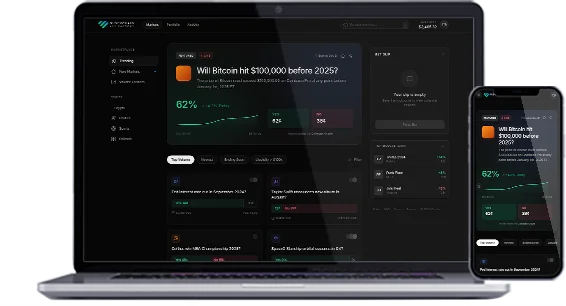

A Hedgehog Markets Clone is a ready-to-launch, customizable prediction market

software package inspired by the Hedgehog Markets trading model. It gives founders a faster path

to build a decentralized prediction market platform without starting from zero. Instead of

spending months stitching together core modules, you get the base product already in place, then

tailor the UI, market rules, and integrations to match your business plan.

At the user level, the platform lets people trade on outcomes like sports results, elections,

crypto price moves, and other yes/no or multi-outcome questions. Traders buy and sell outcome

shares using crypto, and prices move as demand shifts, so the market continuously reflects

collective expectations. Once the result is confirmed through a settlement mechanism, smart

contracts handle resolution and payouts automatically, keeping the flow transparent and

rules-driven.

Launch a Hedgehog Markets Clone for

Decentralized Prediction Markets

If you want to launch a prediction market that

feels and trades like Hedgehog Markets, we’ll build it for you from the ground up. Our Hedgehog

Markets clone development services gives you a production-ready platform structure, then we

customize the full experience around your brand, market categories, and business rules. You get

a faster path to launch because we focus on the parts that matter most: trading UX, market

creation logic, liquidity and pricing behaviour, and a clean back office for day-to-day

operations.

We also make sure the core flow works end-to-end, from creating markets to settling outcomes.

Your users can trade on yes/no or multi-outcome events across crypto, sports, politics, and

other real-world topics, while smart contracts and settlement integrations handle resolution and

payouts based on verified results. Additionally, we can add role-based admin controls, risk

settings, market templates, analytics, and chain deployment options so the platform fits your

roadmap rather than forcing you into a fixed script.